All Categories

Featured

Table of Contents

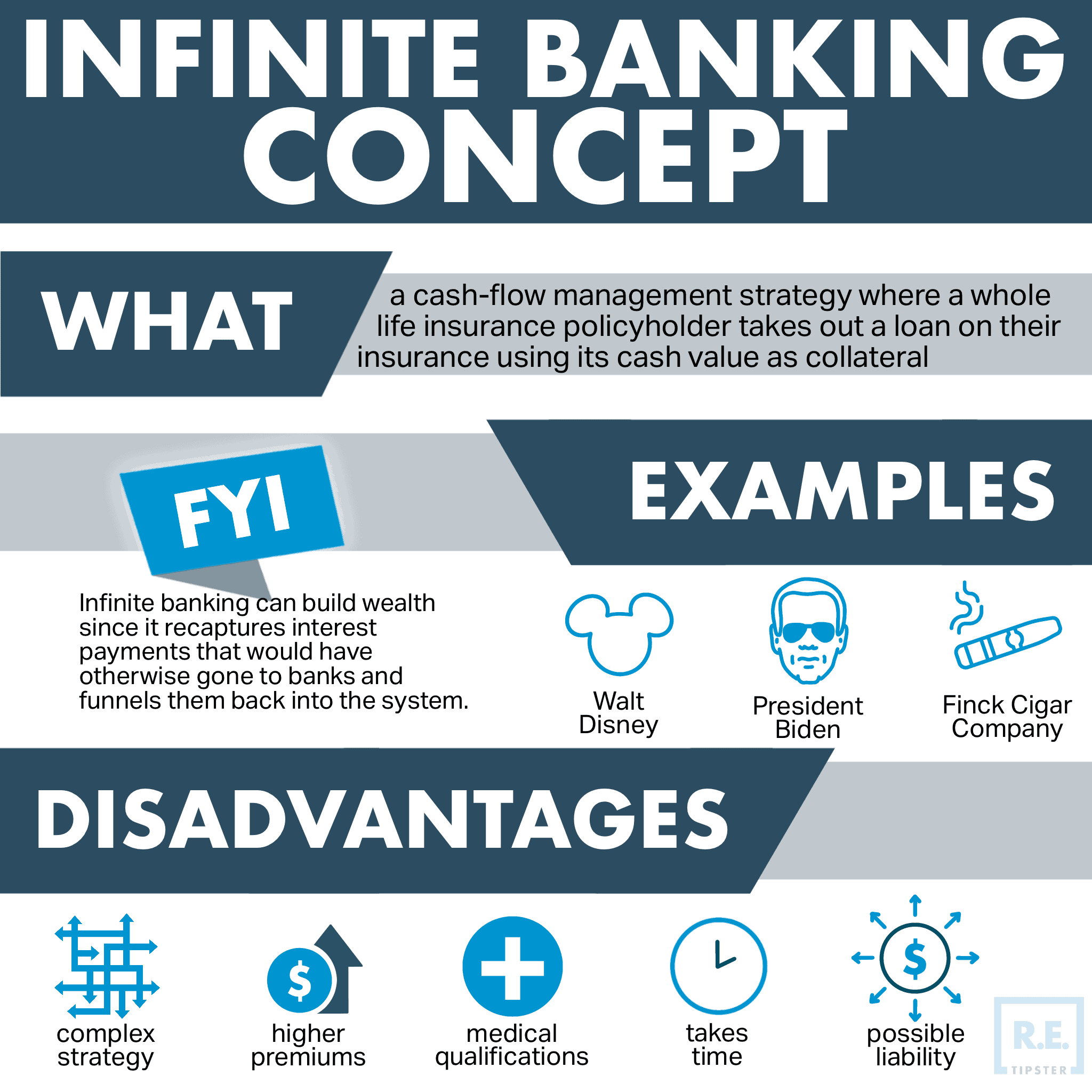

For many people, the largest trouble with the limitless financial idea is that first hit to very early liquidity triggered by the prices. This disadvantage of infinite financial can be reduced considerably with correct policy design, the very first years will always be the worst years with any Whole Life policy.

That claimed, there are particular infinite banking life insurance policy plans created mostly for high early money value (HECV) of over 90% in the very first year. Nonetheless, the long-term performance will certainly frequently considerably delay the best-performing Infinite Financial life insurance policy policies. Having accessibility to that additional 4 figures in the first couple of years may come at the price of 6-figures in the future.

You really obtain some significant long-lasting advantages that help you redeem these early costs and after that some. We locate that this impeded very early liquidity trouble with unlimited banking is extra mental than anything else once extensively discovered. If they definitely required every cent of the cash missing out on from their infinite banking life insurance coverage policy in the very first couple of years.

Tag: boundless financial concept In this episode, I chat concerning finances with Mary Jo Irmen who instructs the Infinite Banking Concept. With the increase of TikTok as an information-sharing platform, monetary advice and methods have located a novel means of dispersing. One such technique that has been making the rounds is the boundless banking idea, or IBC for brief, amassing endorsements from celebrities like rapper Waka Flocka Fire.

Within these plans, the cash worth grows based upon a rate established by the insurance company. Once a significant cash value accumulates, insurance policy holders can get a money value lending. These car loans differ from conventional ones, with life insurance coverage serving as collateral, suggesting one can lose their protection if borrowing exceedingly without adequate money worth to sustain the insurance expenses.

And while the appeal of these plans appears, there are innate constraints and threats, requiring persistent money value tracking. The method's authenticity isn't black and white. For high-net-worth people or local business owner, particularly those making use of techniques like company-owned life insurance policy (COLI), the benefits of tax breaks and compound growth might be appealing.

Bioshock Infinite Vox Cipher Bank

The appeal of unlimited financial does not negate its obstacles: Cost: The foundational requirement, a long-term life insurance policy policy, is pricier than its term counterparts. Eligibility: Not everyone receives whole life insurance policy because of extensive underwriting processes that can omit those with particular health or way of living problems. Complexity and threat: The complex nature of IBC, coupled with its dangers, may discourage lots of, particularly when simpler and less high-risk options are readily available.

Designating around 10% of your monthly income to the plan is simply not feasible for many individuals. Component of what you read below is simply a reiteration of what has already been claimed above.

So before you get yourself into a scenario you're not prepared for, know the adhering to first: Although the concept is commonly offered because of this, you're not actually taking a funding from yourself. If that were the instance, you would not need to repay it. Rather, you're obtaining from the insurance policy company and need to settle it with rate of interest.

Some social networks messages recommend using money worth from entire life insurance to pay down charge card debt. The idea is that when you settle the loan with rate of interest, the amount will be sent back to your investments. However, that's not exactly how it functions. When you repay the finance, a section of that passion mosts likely to the insurance provider.

For the very first numerous years, you'll be repaying the compensation. This makes it incredibly hard for your policy to accumulate value throughout this time. Entire life insurance policy costs 5 to 15 times a lot more than term insurance coverage. Lots of people simply can not manage it. Unless you can pay for to pay a couple of to numerous hundred bucks for the next decade or even more, IBC will not work for you.

Infinite Banking Canada

If you need life insurance, below are some useful ideas to take into consideration: Think about term life insurance coverage. Make sure to shop about for the best price.

Copyright (c) 2023, Intercom, Inc. () with Scheduled Typeface Call "Montserrat". Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Booked Font Style Call "Montserrat".

Concept Bank

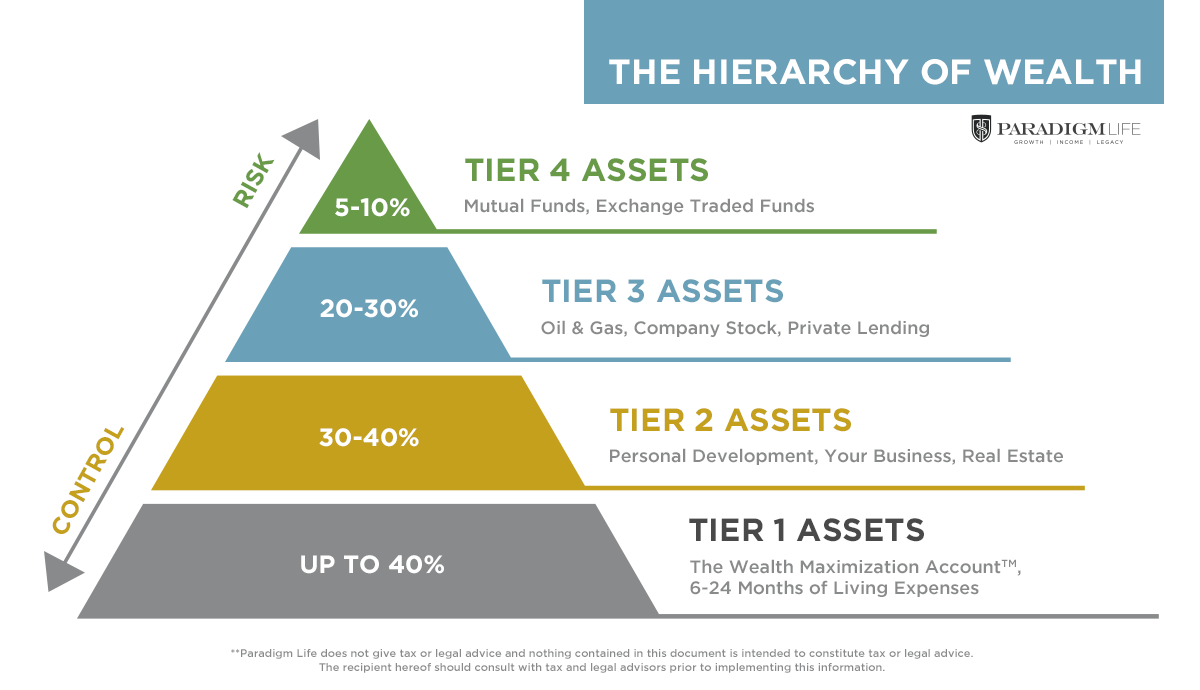

As a certified public accountant focusing on realty investing, I have actually combed shoulders with the "Infinite Banking Idea" (IBC) a lot more times than I can count. I have actually also interviewed experts on the topic. The main draw, aside from the apparent life insurance benefits, was always the idea of constructing up cash money worth within a permanent life insurance policy plan and borrowing against it.

Certain, that makes feeling. Truthfully, I constantly thought that money would certainly be much better spent directly on financial investments rather than funneling it with a life insurance policy Up until I found how IBC might be incorporated with an Irrevocable Life Insurance Coverage Trust (ILIT) to create generational wide range. Allow's start with the essentials.

Start Your Own Bank Free

When you borrow versus your plan's cash money value, there's no collection repayment routine, offering you the freedom to manage the lending on your terms. Meanwhile, the cash money value remains to grow based on the plan's warranties and returns. This arrangement allows you to gain access to liquidity without disrupting the long-term growth of your policy, gave that the lending and interest are handled carefully.

The process proceeds with future generations. As grandchildren are born and expand up, the ILIT can purchase life insurance policies on their lives also. The depend on then gathers multiple plans, each with growing cash values and death benefits. With these policies in position, the ILIT effectively comes to be a "Family members Financial institution." Member of the family can take lendings from the ILIT, using the money value of the plans to fund financial investments, start services, or cover significant expenditures.

A crucial aspect of handling this Family Bank is using the HEMS criterion, which represents "Wellness, Education, Upkeep, or Assistance." This guideline is typically included in trust fund agreements to guide the trustee on how they can disperse funds to recipients. By adhering to the HEMS standard, the count on ensures that circulations are produced crucial requirements and long-lasting assistance, protecting the count on's assets while still offering relative.

Enhanced Flexibility: Unlike rigid bank lendings, you control the settlement terms when borrowing from your own plan. This permits you to framework settlements in a way that lines up with your organization capital. manulife bank visa infinite. Better Cash Circulation: By financing overhead through plan loans, you can possibly maximize cash that would otherwise be locked up in traditional car loan settlements or devices leases

He has the very same tools, but has additionally constructed extra cash money value in his policy and obtained tax advantages. And also, he now has $50,000 offered in his plan to utilize for future chances or expenses. In spite of its possible benefits, some people stay unconvinced of the Infinite Banking Idea. Allow's attend to a few common concerns: "Isn't this just pricey life insurance policy?" While it holds true that the premiums for a properly structured entire life policy may be greater than term insurance, it is essential to view it as greater than simply life insurance.

Infinite Banking Nelson Nash

It's regarding producing an adaptable financing system that gives you control and gives multiple benefits. When made use of tactically, it can complement various other investments and business strategies. If you're interested by the capacity of the Infinite Banking Idea for your company, right here are some actions to take into consideration: Educate Yourself: Dive much deeper into the concept through respectable publications, seminars, or assessments with educated specialists.

Table of Contents

Latest Posts

Infinite H Special Girl Music Bank

Infinity Life Insurance

Be Your Own Bank

More

Latest Posts

Infinite H Special Girl Music Bank

Infinity Life Insurance

Be Your Own Bank